Learn how to buy Injective (INJ) on the Binance platform

There is no doubt one of the most innovative trading platforms in the world nowadays is Binance.

Therefore, the first thing you have to to do if you wish to begin trading on it is to learn how to get Injective (INJ).

Before entering the exciting realm of cryptocurrency within the Binance platform, you will have to know the following.

----

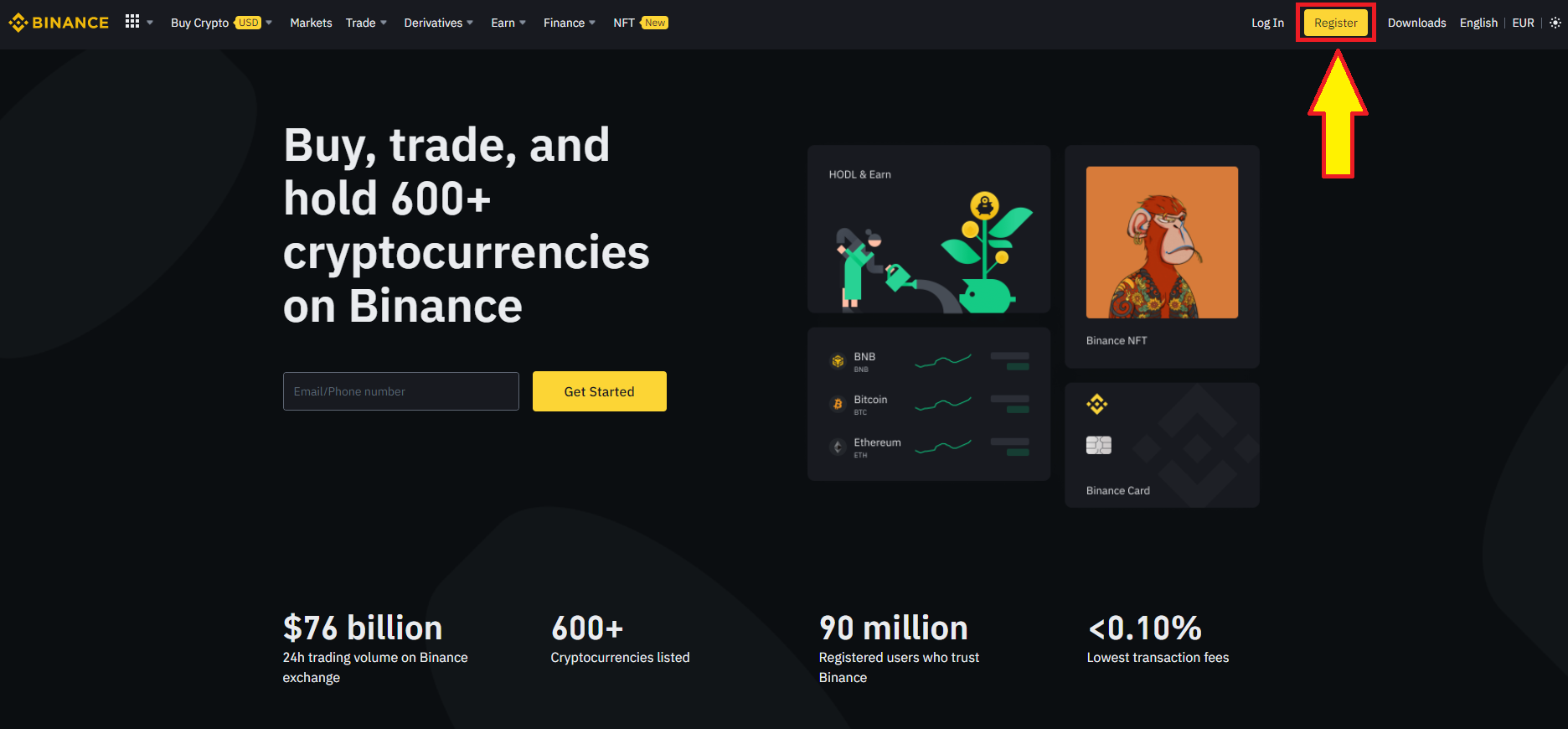

Be able to register on Binance

There’s only way to start trading on Binance: opening an account in it.

Quick and easy registration: just follow the detailed instructions below.

Navigate to the Binance main page and click on the "Register" option.

You have the direct link here.

Look for the "Register with a phone or email" button in the homepage and click on it.

The Binance platform is totally compatible with Apple mobile devices as well.

For the purpose of this article, the email address subscription process will be shown.

- From the drop-down list of countries, select the one you reside.

- Following, enter your email address and a safety password. Keep in mind that you will trade your money, you must give relevance to the password you choose

- Mark if you want to receive information and news directly from Binance in your inbox. Accept the "Terms of Service" and press "Create Account"

The Binance platform will immediately send an activation password (remember: this is NOT the password you’ve created) that you’ll type it in the corresponding box, then click on "Send"

That’s all! You are now registered to Binance.

Now you can access the Binance platform and get to know all the options it has to offer.

You’ll immediately notice how simple is to start trading Injective (INJ).

The ID verification is a required step you must fulfill to gain access to all these options.

It is very important to notice that unless you fulfill this safety step, you will not get permission to begin operating with Injective (INJ).

In the following section, you’ll be guided on how to do it. Zero problems.

How to complete the verification of your account and start trading

Read the next instructions and become an authorized subscriber:

Select "Security" from the drop-down list under the user profile area

Another alternative is to move to the top of the screen and click on the "Verify" button

Locate the option "Identification" on the left part of the screen.

Country of residence must be selected here.

Now you’ll will immediately see three levels of verification:

- The current one.

- The Verified.

- The Verified Plus.

Press the "Start now" button under the "Verified" label, for this is the beginning level.

In this step, some personal data wil be required:

- Nationality.

- First Name and Last name.

- Middle name and birth date.

- Exact address of your residence.

- Second name and date of birth.

- Second name and birth date.

It is time to verify your identity using a legal document.

You can do this with your ID card, passport, or driver’s license.

Follow the system guidance to take a selfie.

Once those steps have been fulfilled, the Binance system will carry out a confirmation process on your account.

Once your request has been approved, the platform will let you know via e-mail, just be patient.

The following instructions will guide you through the Injective (INJ) trading process. As soon as you’ve got the confirmation email, you’re a Binance authorized Injective (INJ) trader.

Buying Injective (INJ) on Binance

Starting your Injective (INJ) trading career has never been so simple, right?.

Understanding how to buy a Injective (INJ) is not that hard.

Next, you’ll need to present a legal document to check your identity.

You can do this by using your passport, ID card, or license.

In the next step, you will be asked to take a selfie, following the application’s requirements.

Now you will have to wait for a short time while an account verification process takes place.

All you need to do is wait patiently, Binance will send you an e-mail when your request has been accepted.

Congratulations! Now you’re officially enabled to buy Injective (INJ). The following instructions will be helpful.

Purchasing Injective (INJ) on Binance

Starting your Injective (INJ) trading experience has never been so easy, right?.

Learning how to buy a Injective (INJ) is not so difficult.

Be aware that you may find different alternatives for this process

Look for the "Buy cryptos" menu on the Binance homepage to know which alternatives are available to you when buying.

Certainly, you’ll only be able to do this after you’ve logged in

Placing your mouse pointer over this option will display a list of alternatives for making the purchase.

Now you’ll need to present a legal document to check your identity.

You can do this by using your ID card, passport, or license.

Follow the system guidance to take a selfie.

When you have fulfilled the platform’s requirements, you’ll have to wait a moment while your account is confirmed.

Now you have to wait until your request has been accepted. Be patient, Binance will let you know via e-mail.

The following instructions will guide you through the Injective (INJ) buying process. As soon as you’ve got the confirmation email, you’re a Binance licensed Injective (INJ) trader.

Buying Injective (INJ) on Binance

Since you are registered on the platform and have your account validated, you’re OK to start trading.

In this segment you’ll discover how easy is to make a purchase of Injective (INJ).

You will probably find different options throughout the process

The "Buy cryptos" menu on the Binance homepage will be your reference at buying time.

Needless to say you must be logged into your account to do this

See all the different buying options just by hovering your mouse over this button.

Buying Injective (INJ) using a credit/debit card

The first thing you need to do to purchase the Injective (INJ) you want using a credit card, should be to select this option from the drop-down list labeled "Buy Cryptos".

After that, just observe these instructions:

Now you must select the currency you want to buy with and indicate the amount you want to invest.

The the Injective (INJ) you would like to purchase must be indicated in the second field

Considering the amount of USD you’ve recently defined, the system will automatically display the quantity of Injective (INJ) you are going to get.

These directions will help you in the process:

Now you must select the currency you wish to use and enter the amount you want to invest.

The the Injective (INJ) you’d like to buy should be indicated in the second field

When you do so, the system will automatically display the quantity of Injective (INJ) you will be given, considering the amount of USD you’ve just invested.

Next click "Continue".

If you decided to pay with a credit card, go to the "Visa/Mastercard" box and press the "Add card" option.

Credit card numbers must be entered in this step, then click "Next".

In this step you must enter the address the credit card is associated to. Type it exactly as it is, then press "Add card".

With this step, your card will be added to the valid methods of payment in your user profile. Press "Continue".

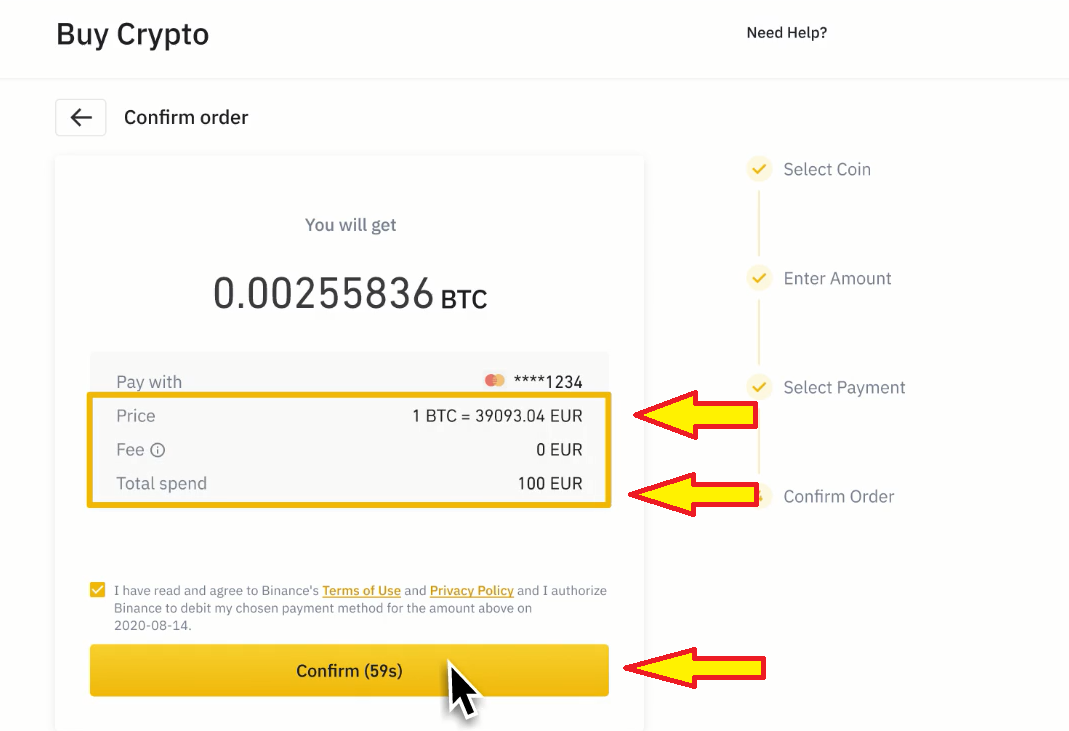

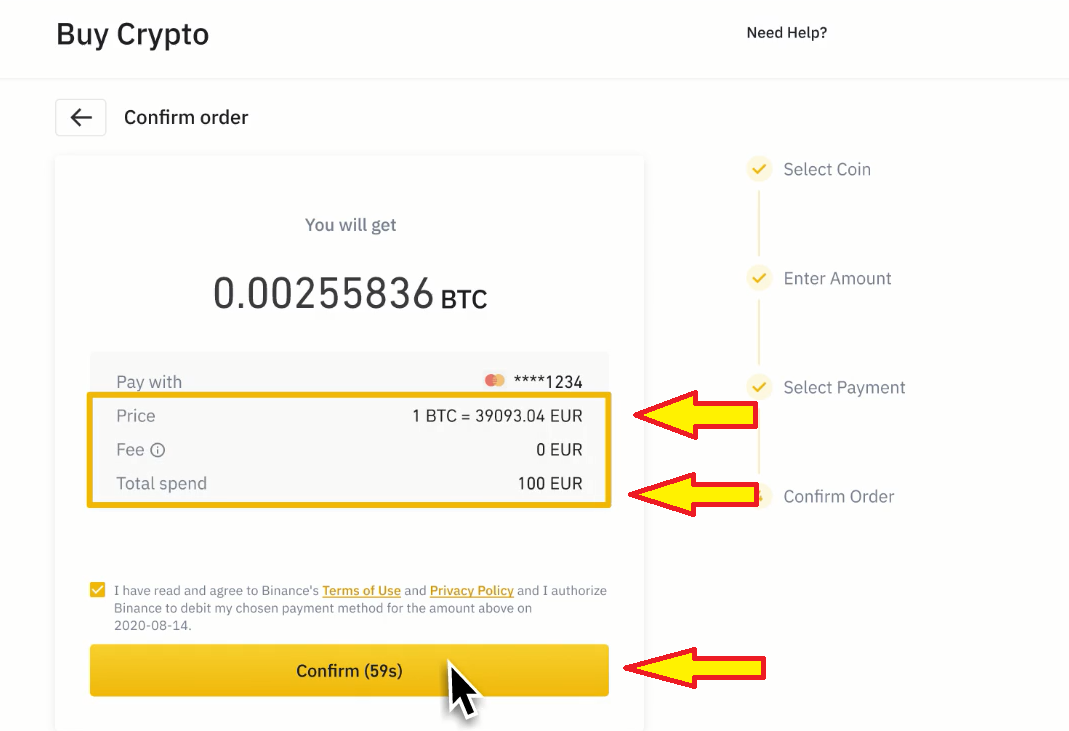

The next screen will display a quick view of the operation in its final stage. It includes the amount you are paying, the selected currency and the quantity of Injective (INJ) purchased.

In fact, Binance will take a certain percentage as a commission for making the transaction, and that will appear in that summary as well.

Now you must validate the order clicking on the "Confirm" button within the next 60 seconds, or it will be automatically terminated.

The next step has to be carried out on the credit card banking system. Follow the directions in the same way you would normally generate a payment with your card.

Your recently bought Injective (INJ) will be available in your Binance e-wallet (referred to as the «Spot Wallet») when the banking process is complete

Purchase Injective (INJ) via Binance P2P

This is a transaction made «Person To Person», i.e.: trading Injective (INJ)

with another Binance user. Payment method is the first setting you should add.

The system will now display the details of the purchase order you are creating. The sum you will pay in the currency you’ve picked, and the Injective (INJ) you will get.

Another detail of relevance in this overview is the percentage Binance will charge you as a commision for making the operation.

Within the next 60 seconds press "Confirm", there after the order will expire automatically.

After this, you will be sent to the bank platform the credit card has been issued by. Proceed exactly as you usually do when making a payment using your card on the bank website.

Your recently bought Injective (INJ) will be available in your Binance e-wallet (called the «Spot Wallet») once the banking process is complete

Purchase Injective (INJ) with Binance P2P

You could get Injective (INJ) not only via a direct purchase, but exchanging them «Person To Person»

with another Binance subscriber too. To achieve this, the first step is to specify which payment method you want to use.

- Go to the "Security" panel of your profile.

- Press "Payment" on the left-hand side of the screen.

- Select "Add a Payment Method" and the Binance platform will guide you through the rest of the process.

When the new method of payment has been included in your profile, look for the "Buy Crypto" menu on the upper bar of the navigator, click the "Trading P2P" button and follow the steps described below:

- On the upper bar of the "P2P Account" menu, choose "Buy"

- The complete set of Injective (INJ) available for buying via P2P trading will be shown in this list, so you will be able to select the one you’re interested in. In this guide, we will present «USDT».It is important to note that when you purchase any crypto through P2P trading, you will be able to exchange it for any of the currencies that operate on the Binance platform.

- Look for the "Fiat" label on the upper menu and deploy the drop-down list to see all available currencies. Let’s use «VES» in this example.

- You must enter the sum in VES you’re going to use in the "Amount" box.

- You will see a list of dealers’ offers as soon as you indicate the payment method.

- Any of the sellers shown in the list can be chosen, but it is recommendable to choose a verified one (with the blue diamond marking), and even better, a high-volume seller (golden star badge).

- Now select "Buy USDT"

- Write the amount in VES you would want to pay

- Click on "Buy USDT" once again

- A buying order has been opened and the trader and you will be able to contact each other for further details, in case you need it. You have a time limit to pay, if you fail doing so the order will be terminated by the system (and that’s not good for your rating as a buyer). Once you paid, press "Transferred, Next", then press "Confirm".

The right way to transfer your Injective (INJ) to the Spot Wallet

When you have made a payment to the seller, they may release the Injective (INJ), just by confirming invoice of the payment.

So, they will immediately be added to your account balance.

Note that you must transfer them to your Spot Wallet in case you would want to buy another cryptocurrency.

To do this, you only need to press "Transfer to Spot Wallet" once the buying order is completed.

If you didn’t do this, don’t stress, you can move the cryptos at any other moment.

Ways to transfer your Injective (INJ) to the Spot Wallet

Cryptocurrencies will be released by the trader as soon as payment reception validation has been done.

You may see your wallet account balance to confirm reception.

NB: you must transfer them to your Spot Wallet in case you want to get another crypto.

You can move them immediately right after the purchase order is completed just by clicking "Transfer to Spot Wallet".

This Injective (INJ) internal movement can be carried out anytime later.

- Place the mouse pointer upon "Wallet" and select "Wallet Funds" from the drop-down list.

- The "Transfer" option is located on the upper right area of the navigator window. Click on it.

- In the pop-up window, swap the «From» and «To» options so that it looks like this:

- From: "Funds"

- To: "Fiat and Spot"

- Select the currency in which you have money, in the example here we use «USDT»

- Set the cryptos you are about to transfer for the Exchange and press "Confirm".

All right! Now you have money available to buy any of the several Injective (INJ) in the Binance platform.

Buy any crypto from the Binance platform just following the instructions described next:

- Find the "Trading" option in the upper panel.

- Click on "Convert" from the list.

- Type the amount of «USDT» you want to spend.

- Now indicate the cryptocurrency you’re about to purchase.

- Click on "Preview conversion".

- Confirm the operation and that’s it. You will have the amount of the selected cryptocurrency in your Spot Wallet.

That’s all! This way you will have funds in the Spot Wallet and you will be able to trade any of the huge selection of Injective (INJ) within the Binance platform.

Purchase any crypto from the Binance platform just following the instructions detailed below:

- Pick the "Trading" option in the top section.

- Click on "Convert" from the list.

- Type the sum of «USDT» you want to spend.

- Now indicate the crypto you’re interested in.

- Select "Preview conversion".

- Validate the operation and that’s it. You now will have the amount of the selected crypto in your Spot Wallet.

This text have surely pictured you a wide vision of what Binance is and how you can do business with Injective (INJ) on it.

So, no time to waste, make a worthwhile business within this crypto platform.